AAVE Price Forecast: Recovery to $190-215 target by January 2026 despite current oversold conditions

Just two thousand

December 25, 2025 at 12:41

AAVE price forecast shows a potential 25-40% rise to the USD 190-215 range within 4-6 weeks, with an oversold RSI at 34.75 and strong support at USD 146.40 setting up a recovery scenario.

AAVE Price Prediction: Recovery moves ahead as oversold conditions create opportunity

The AAVE price prediction landscape has shifted dramatically as the token is trading near critical support levels, presenting significant risk and significant upside potential. With the price of AAVE currently at $151.43, down over 57% from its 52-week high of $357.78, technical indicators suggest a potential reversal is imminent.

AAVE price forecast summary

• Short-term AAVE goal (1 week): $165-175 (+9% to +16%) • Aave medium-term forecast (1 month): Range $190-216 (+25% to +43%)

• Key level that must be broken for the uptrend to continue: $180.34 (SMA 20 resistance) • Critical support if bearish: $146.40 (immediate support level)

Latest Aave price forecasts from analysts

The latest AAVE price forecast consensus among analysts reveals a cautiously optimistic outlook despite the current technical challenges. Blockchain.News issued an Aave forecast targeting $190 in the medium term, citing oversold conditions for the RSI at 35.7 and holding critical support level of $146.40.

A more aggressive forecast comes from LeveX, where it expects an AAVE price target of $340-350 in the short term based on technical breakout patterns with volume confirmation. However, this contrasts sharply with Hexn’s more conservative $150 target, suggesting significant disagreement among analysts about the near-term path.

AInvest’s $216.75 AAVE price target looks more balanced, incorporating both the upcoming v4 upgrade catalyst and rising enterprise adoption trends. The market consensus generally favors a recovery, but the wide range of forecasts ($150-350) indicates a significant amount of uncertainty in current market conditions.

AAVE Technical Analysis: Prepare for an oversold bounce

Current technical analysis of Aave reveals the token is positioned at a critical inflection point. With the RSI at 34.75, AAVE has moved into oversold territory without reaching extreme levels, indicating the potential for a comfortable rally rather than a major reversal.

The MACD histogram at -4.1623 continues to show bearish momentum, but many analysts are pointing to early signs of this momentum weakening. AAVE’s position of 0.08 within the Bollinger Bands puts it very close to the lower band at $145.62, which is the level where bounces historically occur.

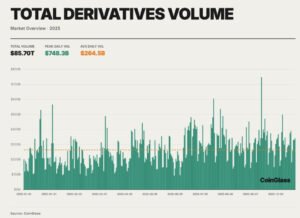

Volume analysis shows mixed signals, with 24-hour trading volume at $11.6 million on Binance representing adequate but not exceptional engagement. A daily ATR of $12.98 indicates normal volatility levels, providing reasonable risk criteria for position sizing.

Even more worrying is that AAVE is positioned below all the major moving averages, with the nearest resistance at the 7-day simple moving average at $161.18. The 20-day simple moving average at $180.34 represents the critical level that must be reclaimed for any sustained outlook for Aave to turn to the upside.

Aave Price Targets: Bull and Bear Scenarios

Bullish case for AAVE

The bullish AAVE price forecast scenario targets the $190-216 range based on several converging factors. Initial resistance at $161.18 (SMA 7) should provide the first test, followed by the more important $180.34 level (SMA 20).

A successful break above $180.34 will activate the $190 AAVE price target set by several analysts. The next logical target is at $216.75, which represents the middle band of the Bollinger Band and a 43% gain from current levels.

The most aggressive scenario sees AAVE reaching the $340-350 range, but this would require a complete trend reversal and a breakout of the strong $232.25 resistance level. This outcome is highly dependent on the V4 upgrade catalyst and the recovery of the broader DeFi market.

Downside risk for Aave

The bearish case for this AAVE price forecast revolves around failure to hold the $146.40 support level. A break below this critical level would likely trigger stops and accelerate selling towards the 52-week low at $138.42.

Further decline could target the $135 level specified in analysts’ forecasts, which represents a 10% decline from current prices. The bearish scenario gains credibility if the RSI breaks below 30 into deep oversold territory while the MACD histogram extends its negative readings.

Risk factors include broader weakness in the cryptocurrency market, poor performance of the DeFi sector, and any delays or issues related to the expected upgrade to v4 which forms the cornerstone of the bullish outlook.

Should you buy AAVE now? Entry strategy

The current setup suggests a measured approach rather than aggressive accumulation. For those considering buying or selling AAVE, the technical picture supports staggered entries rather than large single purchases.

Basic entry area: $146.40-151.43 (current price support)

Secondary input: USD 138.42-142 (if support breaks for deeper value)

Stop loss level: $135 (below 52-week low)

Initial goal: $165-175 (7-day SMA zone)

The position size should take into account the risk ratio of 15-20% to the stop loss level. The risk to reward ratio favors buyers at current levels, with gains of 25-40% possible versus a maximum loss of 10-15% if stops are respected.

For conservative investors, waiting for a break above $161.18 will provide confirmation of the bullish scenario, albeit with slightly higher entry prices.

Conclusion AAVE price forecast

AAVE price forecast maintains a level Medium confidence Uptrend level to $190-216 range over the next 4-6 weeks. The combination of technical oversold conditions, strong support at $146.40, and upcoming fundamental catalysts creates a favorable risk-reward setup.

Key indicators to watch for confirmation include the RSI holding above 30, the MACD histogram stabilizing, and most importantly, a recovery to the $161.18 level with sustained trading volume. Invalidation will occur on a break below $146.40 as selling pressure increases.

Aave’s forecast timeline focuses on the next 4-6 weeks, when technical oversold conditions resolve and fundamental developments around the v4 trend upgrade become available. Traders should remain flexible as a wide range of analyst forecasts suggest a significant amount of uncertainty remains in AAVE’s near-term trajectory.

Image source: Shutterstock

(Tags for translation) AI

Share this content:

Post Comment