Bitcoin drops nearly $3,000 as over $70 million in long positions liquidated over the past four hours.

Key takeaways

- Bitcoin fell during the first US trading session after Christmas.

- This decline led to the liquidation of over $70 million of leveraged long positions on various derivatives platforms.

Share this article

Bitcoin fell as the US market began its first post-Christmas session, falling nearly $3,000 in just a few hours.

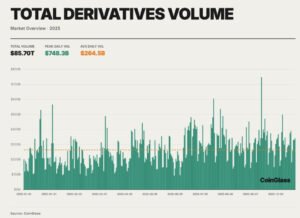

The sudden decline swept the derivatives market, triggering more than $70 million in long liquidations over the course of four hours, according to… Data From Quinglass.

The sharp decline highlights the inherent volatility of cryptocurrency markets, where high leverage magnifies gains and losses. When prices fall rapidly, traders holding long leveraged positions face forced liquidations as their collateral becomes insufficient to maintain open positions.

Mass liquidation events often intensify downward price momentum, as automated selling creates additional selling pressure in an already declining market.

The leading digital asset was trading at $87,175 at press time, down about 2% in the past four hours.

Share this content:

Post Comment