Cryptocurrency fear peaks at Christmas as Bitcoin and Ethereum ETFs continue to inflow

Bitcoin fell below $87,000 on Christmas amid weak liquidity and outflows from ETFs, even as on-chain data indicated an easing of selling pressure.

Bitcoin (BTC) fell below $87,000 during thin trading on Christmas Day on December 25, as outflows from ETFs and weak holiday liquidity kept pressure on the market, according to data shared by XWIN Finance.

The pullback comes even as on-chain metrics point to easing selling pressure and a record accumulation of stablecoin capital, leaving traders torn between caution and the risk of sudden price swings.

ETF outflows and holiday liquidity affect prices

XWIN Finance trend indicator, published on December 25 placed The market is firmly in a “moderate downtrend” with a score of 34 out of 100, citing ongoing withdrawals from ETFs and selling in the US session as the main impediments.

It saw Bitcoin briefly fall below $87,000 before bouncing back, though repeated attempts to reclaim the $88,000 to $89,000 area, an area described by XWIN as intense resistance shaped by positioning, were halted.

Meanwhile, spot bitcoin ETFs continued to see net withdrawals, with nearly 2,900 bitcoins, worth about $251 million, leaving the money in the latest session. This weakness is in line with numbers reported by CryptoPotato on December 24, which Show Cumulative Bitcoin ETF inflows have shrunk by nearly $6 billion since their peak in October. Ethereum funds followed a similar pattern, remaining net negative on a weekly basis despite a slight daily bounce.

In contrast, diversification flows are evident elsewhere. For example, Solana products registered steady inflows, while XRP-linked ETFs added about $8 million in the last session, extending a streak that has made XRP funds an outlier among crypto ETFs.

Bitcoin’s price action reflects this unstable equilibrium, with the asset trading below $88,000 at the time of writing, up about 1% on the day and week, but still roughly 20% lower over three months.

You may also like:

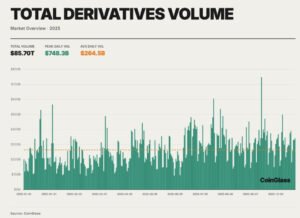

Volatility remained compressed, with a 24-hour range between $87,000 and $88,000, while last week saw volatility between $85,000 and just over $90,000. Relative to the broader market, Bitcoin’s movements were muted, with liquidity-driven wicks outperforming trend-following flows.

Signs on the chain indicate exhaustion, not panic

Beneath weak sentiment, on-chain data paints a more nuanced picture. XWIN noted that whale exchange flows over the past 30 days have been near cycle lows, while coin destroyed days (CDD) are still declining, a sign that long-term coin holders are slowing their selling.

At the same time, there appears to be a fair amount of caution, with spending rising from very old Bitcoin pools, a pattern sometimes seen near major turning points. Network activity also remains weak, indicating that the order is no longer valid.

According to XWIN’s assessment, the current market tension is reflected in sentiment metrics, especially the Fear and Greed Index, which sits at “extreme fear” at 24, while DeFi borrowing has declined sharply since August, indicating low leverage. However, the supply of stablecoins has risen to a record high of close to $310 billion, indicating large pools of marginal capital.

With stocks and gold both on the register Elevations With January interest rate expectations leaning towards a pause, macro conditions are not overtly hostile. However, for cryptocurrencies, XWIN suggested that the next step still hinges on ETF flows and post-expiration options dynamics. Until these shifts occur, the market may remain fragile, even as signs of seller fatigue appear quietly beneath the surface.

Secret Partnership Bonus for CryptoPotato Readers: Use this link To sign up and get $1,500 in exclusive BingX Exchange rewards (limited time offer).

(tags for translation) Bitcoin

Share this content:

Post Comment