From Bitcoin to Ethereum: Exchange data indicates a significant rotation in trading activity

while The price of Bitcoin and Ethereum is still struggling With increasing volatility in the cryptocurrency market, the balance of trading activity between the two leading digital assets is quietly changing. This current pivot is seen across cryptocurrency exchanges as the number of trades displaying a distinct action.

Traders are switching from Bitcoin to Ethereum

Amid the ongoing volatile market phase, increasing disparity has been observed among traders Bitcoin And Ethereum, the largest cryptocurrency asset. in Report From Alphractal, an advanced on-chain investment and data analysis platform, it appears that BTC traders are gradually considering ETH.

After examining the actions of investors, Alphractal revealed the number of permanent market trades completed BTC across major cryptocurrency exchanges It decreased significantly, indicating a decline in short-term activity. Meanwhile, the number of ETH trades has increased with the altcoin taking an increasing share of the overall trade flow, indicating renewed on-chain engagement by traders and players.

According to the platform, more trades are now being processed Ethereumwhich puts the altcoin ahead of Bitcoin in terms of traders’ conviction. This divergence reveals a changing market dynamic as focus and liquidity slowly shift from Bitcoin’s consolidation phase to the growing ecosystem and usage-based activities of Ethereum.

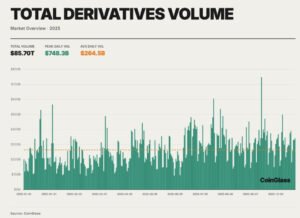

It is worth noting that the market witnessed the largest number of leveraged trades in BTC history between August and November. During this period, more than 19 cryptocurrency exchanges, including BitMEX and HyperLiquid, recorded up to 80 million trades in a single day, an all-time high. However, this activity has declined significantly, and the 7-day average now stands at just 13 million trades. This trend implies a sharp contraction in leveraged trading activity.

On the other hand, Ethereum also saw a boom in 2025, reaching a peak of nearly 50 million transactions. What is striking is that the last number Ethereum Trades are still much higher than those of BTC. Data shows that the 7-day average for ETH is around 17.5 million transactions, indicating a clear difference between the two crypto leaders.

BTC is now in a reset phase after trading decline

Moreover, this indicates that he is in eternity Futures marketBTC and ETH show distinct behavioral patterns. After the massive liquidation event in October, the market turned very cautious towards Bitcoin and leverage itself.

The fractal indicated that the effect of this divergence is clear at its largest Withdrawal of open interest (OI). In the history of Bitcoin. Meanwhile, the platform believes that Bitcoin is currently in a reset phase. At the same time, it will take a long time before conditions return to normal and institutional interest in whales resumes.

At the time of writing, Bitcoin price is trading at $88,875, showing a 1.33% rise over the past 24 hours. Trading volume also followed suit, attracting an increase of over 43% over the same time period.

Featured image from iStock, chart from Tradingview.com

Editing process Bitcoinist focuses on providing well-researched, accurate, and unbiased content. We adhere to strict sourcing standards, and every page is carefully reviewed by our team of senior technology experts and experienced editors. This process ensures the integrity, relevance, and value of our content to our readers.

Share this content:

Post Comment