How the liquidation of cryptocurrency derivatives led to the collapse of Bitcoin in 2025

Forced liquidation in Crypto derivatives market It will reach about $150 billion in 2025, according to CoinGlass data.

On the face of it, the number looks like a year of ongoing crisis. For many retailers, watching their price feed turn red has become a shortcut to chaos. In practice, it has captured something more mundane and structural: the theoretical value of futures contracts and perpetual positions that exchanges forcibly close when margin runs low.

Most of the time, this flow was more of a maintenance function than just a breakdown. In a market where derivatives, not spot markets, determine the marginal price, liquidations acted like a recurring tax on leverage.

The number looked alarming when taken individually. However, against the backdrop of the derivatives machine of 2025, that did not happen.

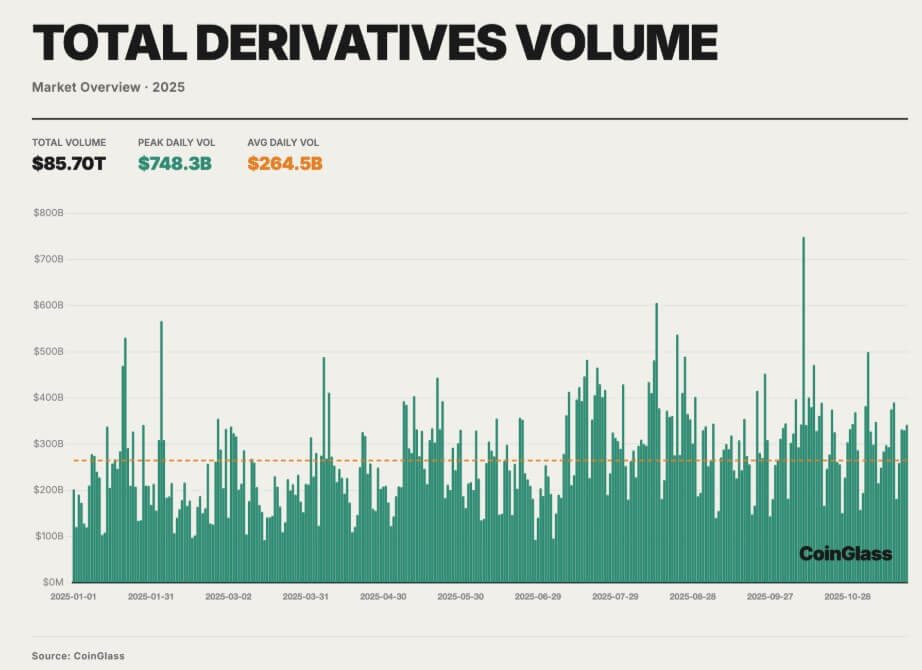

Total cryptocurrency derivatives trading volume was about $85.7 trillion for the year, or about $264.5 billion per day.

In this context, the liquidation proceeds represented a byproduct of a market in which perpetual swaps and fundamental trades were the dominant instruments, and where price discovery was closely coupled to margin engines and liquidation algorithms.

Therefore, as cryptocurrency derivatives volumes rise, market open interest has been steadily rebuilding from the low levels that followed the 2022-2023 deleveraging cycle.

By October 7, virtual open interest across major venues had reached approximately $235.9 billion. Bitcoin traded as high as nearly $126,000 earlier in the year.

The spread between spot prices and futures prices supported a thick layer of underlying trades and carry structures that depended on stable financing and orderly market behavior.

Essentially, the significant pressure was not evenly distributed. This was driven by a combination of record open interest, crowded positions, and a growing share of leverage in the mid- and long-cap markets.

This structure worked until the total shock occurred, when the margin thresholds were tightly clustered and the risks were pointing in the same direction.

The total shock that broke this pattern

The breaking point for the cryptocurrency derivatives market did not come from within the nascent industry. Instead, it was the catalyst Policy driven One of the largest countries in the world.

On October 10, President Donald Trump It announced 100% tariffs on imports from China, and indicated additional export controls on important software.

The statement pushed global risk assets into a sharp move towards risk aversion. In stocks and credit, the adjustment appeared in the form of widening spreads and lower prices. In the crypto space, it hit a market that was long and high and seeing record exposure to derivatives.

The first step was straightforward: spot prices fell as traders reduced risk.

However, in a market where perpetual futures and leveraged swaps dictate the margin markup, that instantaneous movement was enough to push a large block of long positions across their maintenance margin lines.

Therefore, exchanges began liquidating low-margin accounts in order books that were already dwindling as liquidity providers pulled out.

As a result, forced liquidations took place The total market reached more than $19 billion from October 10 to 11.

The majority were on the long side, with estimates suggesting that 85% to 90% of the positions wiped out were bullish bets. The deviation confirmed positioning data that had been weakening for weeks: a one-sided market leaning on the same trade direction and same set of instruments.

The liquidation wave initially followed the standard path. Accounts that violate margin limits are marked for closure. Positions were sold at or near market prices, exhausting quotes and pushing prices into the next stop layer.

Open interest fell by more than $70 billion in a matter of days, falling from a peak in early October to nearly $145.1 billion by the end of the year.

Even after the crash, the year-end figure remained higher than the 2025 starting point, underscoring the leverage built up before the event.

What made October different from the daily action was not the presence of liquidations, but rather their focus and the way product features interacted with depleted liquidity. Funding conditions tightened, volatility rose, and hedging assumptions that had held for much of the year collapsed in a matter of hours.

When warranties turn into speakers

The most significant shift in that window occurred in mechanisms that were normally invisible: backstop exchanges spread when standard filtering logic goes out of the way.

Under normal circumstances, liquidations are handled by selling positions at the bankruptcy price and using insurance funds to absorb any remaining losses.

Automatic reduction (ADL) serves as an emergency behind this process. When losses threaten to exceed what insurance funds and fees can cover, ADL reduces exposure to profitable conflicting accounts to protect the venue’s balance sheet.

From October 10 to 11, this guarantee moved to center stage.

As order books dwindle on some contracts and insurance reserves come under pressure, ADLs have begun to activate more frequently, especially in less liquid markets. Profitable shorts and market makers saw their positions reduced according to pre-determined priority queues, often at prices different from where they would have chosen to trade.

For companies that employ market-neutral or inventory hedging strategies, the impact has been severe. A short futures leg intended to offset spot or altcoin exposure was partially or completely closed out by the venue, converting the intended hedge into realized gains and losses and leaving the remaining risk unprotected.

In some cases, accounts were forced to reduce winning positions in Bitcoin futures while remaining long in thin altcoins that continued to decline.

Market value $1.75T

24 hour volume $43.35B

Highest level ever $126,173.18

The largest distortions appeared in those markets with the long tail. while Bitcoin and Ethereum After falling 10% to 15% during the window, many smaller tokens saw their perpetual contracts drop 50% to 80% from recent levels.

Market value $352.99B

24 hour volume $19.62 billion

Highest level ever $4,946.23

In markets with limited depth, forced selling and ADL hit order books that were not designed to accommodate such a large flow. Prices fell as bids disappeared, and the set prices feeding margin accounts were adjusted accordingly, prompting more accounts to liquidate.

The result was a ring. Liquidations caused prices to fall, widening the gap between index prices and the levels at which ADL events were executed. Market makers who could have intervened with tighter spreads now face uncertain hedging implementation and the possibility of involuntary cutbacks.

As a result, many reduced their bid size or moved wider, reducing visual liquidity and leaving filtering engines working with slimmer records.

This event highlighted a crucial point for a market where derivatives set the bar: collateral that contains risk in normal circumstances can be amplified when too much leverage is piled up in the same direction in the same places.

The collapse wasn’t just “a lot of speculation.” The interplay between product design, margin logic and infrastructure boundaries has been under pressure.

Concentrated spaces and narrow corridors

Concentration in place has shaped market outcomes as much as leverage and product mechanics.

This year, crypto derivatives liquidity has clustered around a small group of large platforms.

For context, Binancethe largest cryptocurrency exchange by trading volume, processed about $25.09 trillion in virtual volume this year, accounting for nearly 30% of the market.

Three others, including OK x, Bybitand PetgateFollowed by $10.76 trillion, $9.43 trillion, and $8.17 trillion, respectively.

Combined, the top four represent approximately 62% of global derivatives trading.

On most days, this focus has simplified the implementation process. It added depth to a few order books and allowed senior traders to transfer risk with predictable slippage. In a tail event, this meant that a relatively small number of venues and risk drivers were responsible for the bulk of liquidations.

During the October holidays, the risks in these places were simultaneously eliminated. Similar ledgers of client positions, similar margin triggers, and similar liquidation logic produced simultaneous waves of forced selling.

The infrastructure connecting these platforms—chain bridges, internal transfer systems, and fiat rails—came under pressure as traders tried to move collateral and rebalance their positions.

As a result, inter-exchange withdrawals and transfers have slowed, narrowing the corridors that companies rely on to arbitrage price gaps and maintain hedging.

When capital cannot move quickly across places, mutual exchange strategies mechanically fail. A trader who is short on one exchange and long on another may see one leg forced down by ADL while being unable to increase margin or transfer collateral in time to protect the other side. Spreads widen as arbitrage capital declines.

Lessons for the crypto derivatives market

The October episode summed up all these dynamics in a two-day stress test. The nearly $150 billion in liquidations over the entire year is now considered less a measure of chaos than a record of how risk was removed in a market dominated by financial derivatives.

In most cases, this liquidation was organized and absorbed by insurance funds and routine liquidation.

The October window revealed the limits of a structure that relied too heavily on a few large venues, high leverage in mid- and long-term assets, and support that could reverse roles under pressure.

Unlike previous crises that focused on credit failure and institutional insolvency, the 2025 event did not trigger a clear cascade of defaults. The system reduced open interest, repriced risk, and continued operation.

The costs have come in the form of concentrated P&L outcomes, a sharp dispersion between large-cap and long-term assets, and a sharper view of how much market behavior is dictated by management rather than narrative.

For traders, exchanges and regulators, the lesson was straightforward. In a market where financial derivatives determine the price, the “liquidation tax” is not just an incidental penalty for over-leveraging. It’s a structural feature, and under hostile macro conditions, it can go from being a routine cleanup to a breakdown driver.

(tags for translation)binance

Share this content:

Post Comment