Japan’s fiscal year 2026 tax reform proposes to impose separate taxes on cryptocurrency trading activities

Tldr:

- Japan’s tax reform positions cryptocurrencies as financial instruments, applying separate taxes to spot transactions, derivatives, and ETFs only.

- The three-year loss carryforward provision matches the treatment of foreign currencies and equities but prohibits aggregation across classes.

- Staking, lending rewards, and NFT transactions remain exempt from separate taxes under the current proposal framework.

- The specific definition of crypto assets limits the scope of the reform to exchanges registered under the Financial Instruments Exchange Act.

Liberal Democratic Party of Japan and Japan Restoration Association unveil Tax reform blueprint for fiscal year 2026 on December 19, which positions cryptocurrency assets as legitimate financial instruments for building wealth.

The proposal introduces separate taxes for specific crypto transactions, including spot trading, derivatives and exchange-traded funds, with provisions for loss carryback for three years.

However, the framework excludes certain activities such as accumulating bonuses and lending, which may continue under general tax rules.

Separate taxes are limited to specific transaction types

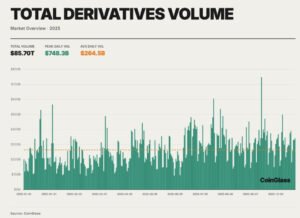

Tax reform Distinguish the chart between different cryptocurrency activities, with separate taxes only applying to specific transaction categories.

Spot trading, derivatives transactions and cryptocurrency ETFs are eligible for the new tax structure, similar to current frameworks for stocks and mutual funds.

The outline indicates a “different direction for the tax regime for virtual currencies (crypto assets)” compared to previous approaches that treated cryptocurrency income uniformly.

Income from mortgages, lending and other reward-based activities remains absent from the separate tax framework.

These transactions generate rewards through holding assets rather than price fluctuations, which creates a fundamental difference in their economic nature. The chart indicates that these activities are likely to maintain their current classification under comprehensive taxation as miscellaneous income.

The fix also introduces uncertainty regarding non-fungible tokens, which was not explicitly mentioned in the proposal. According to experts, “income generated from the purchase and sale of NFTs may still be subject to comprehensive taxation as miscellaneous income.”

This creates a technical paradox since cryptocurrencies and non-fungible tokens (NFTs). Similar blockchain sharing Institutions, but face different tax classifications.

The three-year loss carryforward reflects conventional securities

The scheme allows crypto losses to continue for three consecutive years, in line with the treatment given to forex and stock market losses.

The outline states that “losses related to virtual currency transactions are permitted to be carried forward for a period of three years,” which is consistent with traditional securities provisions. This new provision removes existing restrictions, allowing for more flexible tax planning across multiple fiscal periods.

However, the framework prohibits the aggregation of crypto losses with other investment classes despite similar separate tax treatment.

“Even if a separate tax is imposed, the total scope of profit and loss is strictly divided for each type of income,” experts point out. Each asset class maintains distinct profit and loss accounts, which prevents cross-class tax optimization strategies.

The fix requires a cryptocurrency exchange to submit the transaction Reports to tax authorities, Create infrastructure for accurate income verification.

The scheme “clearly provides for a system for exchange companies to submit reports to the tax office” to support implementation. Enhanced reporting obligations may increase demand for specialized calculation tools as investors navigate more complex filing requirements.

Scope limitations and exit tax considerations

The scheme refers to “specific crypto assets” without specifying specific currencies or qualification criteria.

These terms indicate that the framework applies exclusively to cryptocurrencies “transacted by companies registered under the framework of the Financial Instruments and Exchange Act.”

This designation means that regulatory oversight will determine which digital assets receive separate tax treatment rather than applying it globally.

The reform may also impose an exit tax on cryptocurrency holdings when investors move abroad.

Experts note that “if crypto assets are regulated as financial instruments under the Financial Instruments and Exchanges Act AAnd put them under the tax code “Unrealized gains may face taxes upon departure. This would reflect the treatment of the current stock of assets that exceed certain thresholds.

Implementation details remain pending future legislation and regulatory guidance. The scheme provides a guiding intent while leaving specific mechanisms, qualification criteria and implementation procedures for subsequent legal development.

(Tags for translation) Cryptocurrency assets in Japan

Share this content:

Post Comment