Russia opens the door to Bitcoin for retail investors

The Bank of Russia has established a new framework for regulating cryptocurrencies, proposing tiered access that would allow ordinary investors to purchase digital assets alongside professional market participants, while maintaining strict controls on risk and use.

In concept paper Released on Tuesday and submitted to the government for review, the central bank said eligible and non-qualified investors will be allowed to acquire cryptocurrency assets, but under different rules, limits and testing requirements.

This step represents another step in Russia Gradual transformation Toward the uptake of digital assets as sanctions reshape financial flows and market infrastructure.

Earlier this year, the Bank of Russia moved to allow local banks to conduct limited crypto operations under strict supervision. First Deputy Chairman of the Board of Directors, Vladimir Chistyukhin, said that the Central Bank, while maintaining a conservative position on assets such as Bitcoin, no longer sees a justification for completely excluding banks from this activity.

It is also reported that Russia He was using Bitcoin To settle some oil deals with China and India, and route payments through intermediaries to bypass Western sanctions.

However, the current proposal maintains the central bank’s proposals Caution for a long time towards cryptocurrencies, which continue to be classified as high-risk instruments.

The Bank of Russia warned that crypto assets are not issued or guaranteed by any jurisdiction, are subject to sharp price fluctuations, and carry high penalties and operational risks. She said investors must fully accept the possibility of losing their money.

Maximum limit of $3,800 for retail investors in Russia

Under this framework, non-qualified investors or individuals will be allowed to purchase only the most liquid cryptocurrencies, based on criteria that will be defined in the legislation.

Access will be conditional on passing a knowledge test, and purchases will be capped at 300,000 rubles (about $3,800) per year through a single broker.

Qualified investors will face fewer restrictions. They will be allowed to purchase any cryptocurrency without transaction limits, provided they pass a test confirming their understanding of the risks. However, anonymous cryptocurrencies — defined as tokens whose smart contracts hide information about transaction recipients — will remain banned.

Cryptocurrencies and stablecoins will be officially recognized as fiat assets under the proposal, meaning they can be bought and sold.

Their use as a domestic payment method within Russia will remain prohibited, strengthening the central bank’s position that cryptocurrencies should not serve as a substitute for the ruble in daily transactions.

Cryptocurrencies will be traded through Existing licensed infrastructure. Exchanges, brokers and custodians will be able to offer cryptocurrency services under their existing licences, while additional requirements will apply to specialist cryptocurrency depositories and exchanges.

The framework also allows Russian residents to purchase cryptocurrencies abroad using foreign accounts and transfer previously acquired cryptocurrencies abroad through Russian intermediaries. Such transactions require notification to the tax authorities.

Beyond cryptocurrencies, the proposal extends to digital financial assets (DFAs) and other Russian digital rights, including utility and hybrid instruments. Their trading will be allowed on open networks, a move aimed at helping issuers attract foreign investment and giving investors access to DFAs on similar terms to cryptocurrency assets.

The Bank of Russia aims to complete the legislative framework by July 1, 2026. From July 1, 2027, it plans to introduce liability for illegal activity carried out by cryptocurrency brokers, in line with penalties for illegal banking operations.

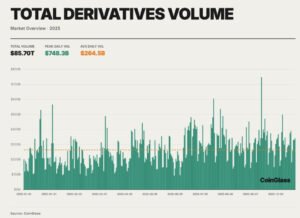

At the time of writing, Bitcoin is trading at $87,555, with 24-hour trading volume of $47 billion, down 3% from the last day.

The price remained about 3% below its seven-day high of $90,069 and about 1% above its seven-day low of $87,096. Bitcoin’s circulating supply reached 19,965,971 coins out of a maximum supply of 21 million, giving the network a global market cap of about $1.75 trillion, down 3% from 24 hours prior.

Share this content:

Post Comment