The next stage for cryptocurrencies is utility, not price action: CoinShares

The digital asset market recorded an exceptional performance in 2025, broadly confirming predictions made the previous year, according to… Currency stocks.

Bitcoin has reached all-time highs while cryptocurrencies have returned to daily corporate and media discourse – this time in a much more positive light than during the economic downturn of 2022-2023.

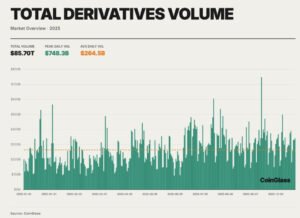

The year was not without turmoil. The periods of volatility and liquidation events served as a reminder that cryptocurrencies are still an emerging asset class.

Currency stocks He argues that focusing exclusively on price action risks overlooking the deeper progress the industry has made. After years of continuous construction, the foundations supporting digital assets have been materially strengthened.

Digital assets are moving within the traditional economy

CoinShares notes that digital assets no longer operate outside the traditional financial system. Instead, these institutions have become increasingly embedded within it, enhancing the underlying financial infrastructure rather than trying to replace it directly.

Advances in 2025 were crucial in both technology and its adoption. The industry has matured beyond its speculative instincts, with interest shifting toward protocols and applications that provide measurable real-world benefit.

The projects that are gaining more attention today are those that solve tangible economic problems, rather than chasing short-term narrative momentum.

Benefit on narrative signals market maturity

From CoinShares’ point of view, the most important indicators of the trend of cryptocurrencies are practical integration rather than speculative cycles. Chainlink The growing role in connecting blockchain networks with established standard providers provides a clearer indication of the market’s evolution than any meme-driven rise.

At the consumer level, the emergence of prediction markets like Polymarket and Kalshi demonstrates that cryptocurrency-enabled apps are reaching a product market niche. These platforms are no longer experimental; They are operable, organized into parts, and increasingly used.

Meanwhile, in the US, spot Bitcoin ETFs have begun to achieve mainstream adoption, gradually reshaping perceptions through familiarity rather than hype.

2026: Adoption matters more than overall incentives

Looking ahead, CoinShares acknowledges that many market participants expect a new macro stimulus in 2026, possibly through renewed liquidity from the Federal Reserve. While such developments may impact markets, CoinShares says adoption will be the most important force.

In 2026, CoinShares says app-based retail savings products may begin to compete directly with bank deposits as payment companies, fintechs and banks expand stablecoin settlement, custody and trading services. Although these changes are gradual, they are structural and difficult to reverse once established.

Economic purpose will determine the winners

In this environment, CoinShares believes that winners will be determined by economic function rather than narrative appeal. Bitcoin continues to strengthen its role as a global non-sovereign asset.

Stablecoins are evolving into settlement bars for a more digital and international economy. Tokenized financial products are starting to move from demo programs to real release.

As these paths mature, DeFi increasingly resembles finance itself – delivered through different technology rather than positioned as a parallel system.

Regulation enables expansion, not repression

CoinShares highlights meaningful regulatory progress, particularly in the US, where recent legislative developments have clarified frameworks for stablecoins, token assets and market infrastructure.

For Europe, the company sees the opportunity in consistent and practical implementation of regulation that attracts long-term institutional capital.

The goal should not be to limit innovation through uncertainty, but rather to make innovation safe enough to scale.

From a gentle return to the consolidation of the real economy

Currency stocks He also warns that future cycles will continue to produce small bubbles. Some topics will attract excessive capital, and some projects will fail. She says this is inevitable in a rapidly evolving frontier market.

The company believes that the travel trend is becoming increasingly clear. The market is moving towards utilities, cash flow and integration. If 2025 represents a fantastic return for cryptocurrencies, CoinShares concludes that 2026 is shaping up to be the year digital assets are integrated into the real economy.

Share this content:

Post Comment