XRP 2025: New Highs After 7 Years as Ripple’s SEC Case Finally Ends

short

- Ripple Labs ended a years-long court battle with the Securities and Exchange Commission in 2025, making way for new growth for the company.

- This helped fuel the rise of Ripple-linked XRP to a new all-time high of $3.65.

- The company’s stablecoin has also boomed to a market capitalization of more than $1 billion, and it has made four major acquisitions, helping its value grow to $40 billion.

Cryptocurrency’s biggest gains are often closely linked to rising asset prices, but Ripple’s successes in 2025 extend far beyond the cryptocurrency’s price. XRP– Assets related to Ripple, which are among the top five crypto assets in terms of market capitalization.

Instead, most of the headlines associated with the financial services organization have been irrelevant to trading screens, most notably the outcome of its years-long battle with the Securities and Exchange Commission, major acquisitions to drive its future growth, and the launch of a $1 billion stablecoin product – RLUSD.

Below we’ll take a look at the most notable events for XRP and Ripple in 2025.

The Ripple and SEC saga is over

More than four years after its inception, the legal dispute between Ripple Labs Inc. and… The US Securities and Exchange Commission (SEC) It officially comes to an end in August.

The landmark case, which investigated whether or not XRP sales violated securities laws, stretched back to December 2020. In 2023, a partial ruling was issued in favor of Ripple Labs, but appeals and counter-appeals extended the saga until 2025.

However, with the election of President Donald Trump and Crypto-friendly regulatory managementthe pair chose to find Reach a jointly negotiated solution in early 2025.

This was a later negotiated decision A U.S. District Judge rejected itSubsequently dismissed by the courts, the pair eventually agreed to drop their appeals, ending the case for good and cementing the 2023 ruling in favor of Ripple as a precedent for future cryptocurrency rankings.

XRP marks a new all-time high

Before 2025, XRP last traded above $3.00 in 2018.

Seven years later, about a month before the years-long legal battle between Ripple Labs and the Securities and Exchange Commission ended, the Ripple-pegged coin XRP emerged. It made a new all-time high of $3.65According to CoinGecko data, it surpassed its previous high of $3.40 in 2018.

This made XRP the third largest cryptocurrency asset by market capitalization at the time, behind only Bitcoin and Ethereum. As regulatory scrutiny declined, analysts said at the time Decryption that investors”I believed in Ripple’s vision of an enterprise blockchain.“

Although its meteoric rise has put the token in a range not seen since 2018, investment firms like Standard Chartered maintained higher year-end price targets for XRP over the summer — anticipating a move to $5.50 by the end of the year.

This sign seems unlikely now, despite the acceleration Coding direction This has been highlighted by Standard Chartered as a potential catalyst for the XRP price.

XRP, now the fourth-largest asset by market cap, was trading at $1.90 as of December 15, about 48% from its all-time high in July.

XRP joins the ETF party

Following the approval and subsequent success of ETFs for cryptocurrency companies Bitcoin and Ethereum, both investors and fund issuers have been eager to bring altcoin ETFs – such as those for XRP, Solana, and Dogecoin – to market.

As a result, applications for altcoin ETFs flooded the SEC, and by June, expert opinions predicted their potential. Approvals as “soon closing” for 2025. These views were further validated in September when The Securities and Exchange Commission has paved the way for the approval of new ETFs By signing the new public listing standards.

Around that time, it was Rex stock and Osprey funds It got its own XRP ETF into the market– It is an Act 40 ETF that follows different listing standards than other cryptocurrency ETFs. The demand for the product was displayed immediately, It earned $38 million on the first day of the volume, Good enough to mark the biggest debut of the year to that point.

Shortly thereafter, more traditional ETF products emerged from… Canary CapitalGrayscale and Bitwise Franklin Templeton Hit the market. In December, leveraged products also hit the market, allowing investors to… Double their exposure to XRP gains.

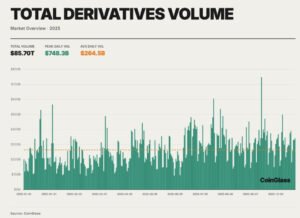

Since their launch, spot ETFs have generated nearly $1 billion in net inflows without a single day of outflows, According to CoinGlass dataeffective December 15.

RLUSD becomes a $1 billion stablecoin

XRP crosses a major milestone in 2025, as does Ripple Labs’ stablecoin, RLUSD.

Firstly It was launched in December 2024the dollar-backed stablecoin has led the growing trend of stablecoin products from other financial giants such as western union and JP Morganand the passage of the GENIUS Act, which provided regulatory clarity regarding the issuance and trading of tokens backed by fiat currencies.

In the year following its launch, RLUSD’s functionality expanded. In September it was Added to Securitize’s tokenization platforma platform powered by BlackRock that now allows users to exchange its shares symbolic Money market funds for RLUSD. In December the company Received approval to expand payment servicesincluding RLUSD, in Singapore as well.

It is used For credit card settlements Also, thanks to the partnership with Mastercard and WebBank, the issuer of the credit card products of the Gemini cryptocurrency exchange.

While RLUSD is regulated by the New York Department of Financial Services, Ripple has applied for it Charter of the National Bank in Julyfollowing in the footsteps of the USDC issuer circle, as it aims to become “Standard of trust” In the stablecoin market. And it happened Conditional approval In December, along with other stablecoin issuers.

At the time of writing, the stablecoin has reached a market capitalization of $1.3 billion, making it the 11th largest stablecoin in less than a year since its launch. According to data from DefiLlama.

Ripple shopping spree

Although closely linked to XRP, Ripple is much larger and more expansive than a single crypto token, and its footprint has grown significantly throughout 2025 thanks to major acquisitions.

In April the company It forked over $1.25 billion to acquire prime brokerage Hidden Road Because it aims to better serve institutional clients on a broader scale.

Then he spent Another $1 billion to acquire treasury asset management company GTreasury in October, in a play that would reduce friction and costs associated with legacy financial systems, according to CEO Brad Garlinghouse.

This acquisition was taken with two others, paid $200 million to add Toronto-based stablecoin platform Rail, And an undisclosed amount Wallet as a Service provider Palisade.

Finally, Ripple’s acquisitions in 2025 maintain a similar theme, improving payment efficiency while expanding its financial services offerings.

These moves have helped the company Achieved an investment of $500 million In November, it was valued at $40 billion and cemented its place among the current and future leaders of the cryptocurrency industry.

“This investment is not only a validation of Ripple’s growth strategy and business built around XRP, but it is also a clear bet on what the future of cryptocurrencies will look like,” Ripple CEO Brad Garlinghouse said. Written on X. “I’m very proud of what we’ve built, and everything that’s to come.”

Daily debriefing Newsletter

Start each day with the latest news, plus original features, podcasts, videos and more.

Post Comment