XRP 2025: New Highs After 7 Years as Ripple’s SEC Case Finally Ends

Introduction to XRP and Ripple

XRP is a digital cryptocurrency that was created in 2012 by the company Ripple Labs, Inc. It serves as a bridge currency in financial transactions, facilitating cross-border payments efficiently and with reduced fees, which is a significant advancement over traditional banking methods. The unique consensus algorithm that underlies XRP allows for quick transaction settlements, positioning it as an attractive option for financial institutions seeking to streamline their operations.

Ripple, the company behind XRP, aims to establish a robust and scalable network that enhances the movement of money globally. With its strategic partnerships and technology-focused approach, Ripple seeks to provide solutions that engage banks and financial service providers, thus boosting adoption rates for XRP. The use case of XRP within the Ripple ecosystem is primarily centered on enhancing liquidity for cross-border transactions, allowing businesses to transact seamlessly across currencies.

Over the years, XRP has attracted significant attention in the cryptocurrency space, largely due to the legal battles faced by Ripple regarding SEC regulations. The outcomes of these proceedings could potentially influence XRP’s value and its role within the broader financial infrastructure. As the year 2025 approaches, many analysts anticipate that resolution of the ongoing legal disputes may lead to renewed interest in XRP and possibly ushering it into a new era of growth. As the cryptocurrency landscape evolves, the anticipated developments surrounding XRP present opportunities for investors and stakeholders alike, making it a focal point in discussions about the future of digital currencies.

Timeline of Ripple’s SEC Case

The legal battle between Ripple Labs and the U.S. Securities and Exchange Commission (SEC) is pivotal in understanding the future of XRP and its potential for new highs by 2025. The saga began in December 2020 when the SEC filed a lawsuit against Ripple, alleging that it had conducted an unregistered securities offering through the sale of XRP. This accusation brought significant concern to investors and the wider cryptocurrency market, leading to various exchanges temporarily halting XRP trading.

As the case progressed, Ripple took a firm stance, arguing that XRP should not be classified as a security, given its utility and function within the network. The legal arguments presented by Ripple indicated that XRP functions as a means of exchange, supporting the platform’s operations rather than fitting the traditional mold of a security. This defense underscored the growing divide between regulatory agencies and innovative cryptocurrency technologies.

Key rulings occurred throughout the case, including a notable decision in 2021 where the court granted Ripple access to SEC internal documents. This development was seen as a strategic victory for Ripple, bolstering their defense. By 2023, Judge Analisa Torres ruled that XRP is not a security when sold on secondary markets, a landmark decision that had the potential to reshape regulatory approaches toward cryptocurrencies.

Through this timeline, various events, such as testimonies from industry experts and fluctuations in the XRP market value, have influenced public perception and investment strategies. Understanding these legal milestones is essential for anticipating the implications for XRP as Ripple continues to navigate its post-SEC landscape, preparing for potential new highs by 2025.

Impact of the SEC Case on XRP Price

The ongoing legal battle between Ripple Labs and the U.S. Securities and Exchange Commission (SEC) has significantly impacted the price of XRP, Ripple’s native cryptocurrency. When the SEC filed its lawsuit in December 2020, claiming that XRP was an unregistered security, the price of XRP experienced a swift and dramatic decline. This initial reaction led to a loss of investor confidence, depreciating the asset from around $0.60 to approximately $0.20 in just a few days. Such volatility illustrated the crucial relationship between regulatory scrutiny and market perception of cryptocurrency assets.

As the lawsuit progressed, the market responded variably, reflecting shifting public sentiment. For instance, positive developments in the case, such as rulings that favored Ripple, often corresponded with short-term price surges. These phases of optimism demonstrated how critical the SEC’s appeals and judicial decisions were in shaping investor outlook and XRP price movements. On the contrary, any negative news, including setbacks in the legal proceedings, led to further declines in XRP’s valuation, underscoring the fragile nature of market confidence in the face of regulatory uncertainty.

It is also notable that the case attracted significant media attention, fueling public interest and engagement in XRP and the broader cryptocurrency market. Investors closely monitored the developments, which at times led to speculative trading activity. As discussions about the importance of utility and regulatory clarity gained prominence through 2023, many in the cryptocurrency community began to speculate on XRP’s potential rebound. The eventual resolution of the SEC case is anticipated to redefine XRP’s position in the crypto landscape, potentially elevating its market value as the legal clouds dissipate.

Current Status of the SEC Case

The ongoing legal battle between Ripple Labs Inc. and the U.S. Securities and Exchange Commission (SEC) has captured significant attention in the cryptocurrency landscape. As of October 2023, the case is notably at a pivotal juncture, with recent rulings steering the discourse on whether XRP, Ripple’s digital asset, should be classified as a security. The SEC’s allegations that Ripple conducted an unregistered securities offering have prompted debates on regulatory frameworks applicable to cryptocurrencies.

Recent judgments have produced mixed outcomes. In a notable ruling, the court acknowledged that XRP could be classified as a non-security in certain contexts, an interpretation welcomed by Ripple and its supporters. This rift in the SEC’s stance introduces optimism for many investors who are closely monitoring potential price fluctuations of XRP. The developments in this legal battle highlight the complexities of cryptocurrency regulations and set a precedent for how similar cases might unfold in the future.

The implications of the SEC case’s current status are profound not only for Ripple but also for the broader cryptocurrency space. A favorable ruling for Ripple could signal a shift in how regulators approach digital assets, emboldening other projects and potentially elevating XRP’s standing in the market. Conversely, adverse judgments could create stronger regulatory pressures, impacting investor confidence and long-term market dynamics. Investors are increasingly looking to 2025, anticipating that resolution of the SEC dispute could result in new highs for XRP, as increased clarity may encourage wider adoption and institutional investment.

Market Response and XRP Predictions for 2025

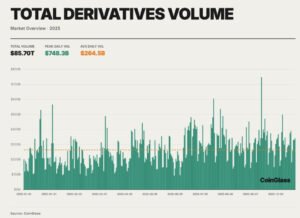

The conclusion of Ripple’s SEC case has resulted in profound implications for the cryptocurrency market, particularly for XRP. Following the announcement, trading volumes experienced a significant surge, underscoring renewed investor interest. Many market participants now view XRP not merely as a cryptocurrency but as a legitimate asset with the potential for long-term growth. This renewed confidence is crucial, especially for investors who have endured years of uncertainty surrounding regulatory implications.

Investor sentiment is notably positive, as many are speculating on the future trajectory of XRP heading into 2025. Analysts have started to express bullish predictions based on several factors including increased institutional adoption, potential new partnerships, and the overall maturation of the cryptocurrency ecosystem. It is anticipated that as Ripple continues to expand its use cases beyond remittances, XRP may see higher demand, further propelling its price.

Market experts predict that XRP could reach new highs by 2025, driven by a convergence of regulatory clarity and robust market dynamics. Some forecasts suggest that the price could potentially double or even triple from its current standing, depending on macroeconomic conditions and continued acceptance among financial institutions. Furthermore, the expected advancement in Ripple’s technology and its applications in cross-border transactions could solidify XRP’s position within the digital financial landscape.

In essence, the positive resolution of Ripple’s SEC legal battle not only enhances XRP’s credibility but also positions it for significant growth. With an optimistic outlook, many anticipate that XRP will not only recover lost ground but also set new benchmarks in the coming years, as the market responds favorably to this pivotal moment in its history.

Technological Developments and Ripple’s Future

With the recent resolution of the SEC case, Ripple stands poised to usher in a new chapter focused on innovation and expansion. The resolution has lifted a significant cloud of uncertainty that hindered Ripple’s growth trajectory and has now paved the way for the development and implementation of cutting-edge technologies that could redefine the financial landscape.

Ripple has always emphasized its commitment to the advancement of digital payment systems, and this strategic objective will likely continue following the favorable ruling regarding XRP. The firm’s flagship product, RippleNet, alongside its native digital asset, XRP, is geared towards revolutionizing cross-border payments. Enhancements to the RippleNet platform are expected to promote seamless integration of traditional financial institutions with blockchain technology, increasing efficiency and reducing transaction costs.

Moreover, partnerships with various financial entities will play a crucial role in expanding the use cases for XRP. Ripple’s collaborations with banks, payment providers, and remittance services will facilitate a broader acceptance and integration of XRP in everyday transactions. The company’s ability to demonstrate real-world use cases for XRP will fundamentally influence its reliability and stability in the market, which may subsequently drive higher adoption rates among businesses.

As we look toward XRP 2025, the focus on technological advancements will not solely be about maintaining its current market position but also about strategizing for sustainable growth amidst evolving market conditions. Ripple’s roadmap will incorporate innovative solutions like the enhancement of liquidity provision, targeting new markets, and advancing the overarching goal of financial inclusivity. This proactive approach will ensure that XRP remains adaptable and competitive in a dynamic digital asset landscape.

Comparison with Other Cryptocurrencies

The cryptocurrency market has grown immensely over the past decade, with numerous players vying for position and dominance. Among these, Ripple’s XRP stands out, particularly as 2025 approaches. With the ongoing resolution of Ripple’s SEC case, it is essential to compare XRP’s market dynamics with leading cryptocurrencies, notably Bitcoin and Ethereum. This comparison allows for a clearer perspective on XRP’s potential trajectory.

Bitcoin, being the first cryptocurrency, holds a significant share of the market cap and is often viewed as a digital gold. Its decentralized nature and limited supply make it attractive to investors seeking a hedge against inflation. In contrast, Ethereum, which supports decentralized applications and smart contracts, offers a robust ecosystem that enables innovation and new use cases. These characteristics have positioned both Bitcoin and Ethereum as formidable competitors in the market.

XRP’s unique value proposition lies in its focus on facilitating cross-border payments through the RippleNet network. This distinct utility sets XRP apart from Bitcoin and Ethereum, whose primary use cases involve store-of-value and decentralized applications, respectively. The outcome of Ripple’s SEC case may provide the catalyst needed for XRP’s price appreciation as regulatory clarity could enhance institutional confidence and drive adoption.

The resolution of the SEC case potentially highlights XRP’s viability as a legitimate financial asset, differentiating it from other cryptocurrencies that have faced similar regulatory scrutiny. Furthermore, as traditional financial institutions increasingly embrace blockchain technology, XRP’s partnerships and collaborations could leverage this momentum effectively against its competitors. With the perspective of XRP in 2025, its ability to coexist and thrive alongside Bitcoin and Ethereum could significantly reshape market dynamics.

Regulatory Landscape for Cryptocurrencies in 2025

As we approach 2025, the regulatory landscape for cryptocurrencies is expected to undergo significant transformation. Governments and regulatory bodies around the world are increasingly recognizing the importance of establishing clear frameworks for digital currencies. These frameworks aim to foster innovation while ensuring consumer protection and financial stability. The evolving regulations will likely play a pivotal role in shaping the future of cryptocurrencies, including Ripple’s XRP.

One of the primary factors influencing the regulatory environment is the push for enhanced transparency and accountability in the cryptocurrency markets. By 2025, it is anticipated that regulations will demand more rigorous reporting standards from crypto companies like Ripple, which could influence how XRP is perceived and utilized. Compliance with these regulations may redefine business models and operational strategies within the crypto space.

Furthermore, jurisdictions that adopt proactive and clear regulations for digital assets are likely to attract more innovators and capital. This shift towards supportive regulatory frameworks may afford Ripple greater opportunities to expand its market presence and enhance the utility of XRP. A favorable regulatory environment could lead to increased institutional adoption of XRP and a higher level of integration with traditional financial systems.

However, the regulatory landscape is not without challenges. Potential regulatory crackdowns or ambiguous laws in different regions could pose risks to the adoption and growth of XRP. As Ripple navigates these complexities, its ability to effectively adapt to varying regulations will be crucial. The outcome of Ripple’s ongoing legal battles with the SEC will also considerably influence perceptions of XRP and its future in the market.

In summary, the cryptocurrency regulatory landscape for 2025 is likely to be characterized by greater clarity and strict oversight, impacting XRP’s strategic direction and growth potential for Ripple as a whole.

Conclusion: The Future of XRP

As we reflect on the evolution of XRP and the legal ramifications of Ripple’s SEC case, it is evident that the resolution of this legal struggle marks a significant turning point for the cryptocurrency market. The past few years have been tumultuous for XRP, with regulatory uncertainty creating a challenging environment for investors and stakeholders alike. However, the recent developments signal a newfound optimism, potentially setting the stage for XRP to achieve new heights as we approach 2025.

The historical context of Ripple’s positioning within the financial industry plays an essential role in understanding its future trajectory. Ripple has consistently aimed to facilitate cross-border payments more efficiently than traditional banking systems. With the SEC case resolution, the possibility of broader acceptance and integration of XRP into various financial platforms could lead to enhanced liquidity and adoption. This potential growth could redefine how cryptocurrencies are perceived and utilized globally.

Moreover, key developments in technology, alongside Ripple’s continuous efforts to innovate its services, suggest a strong likelihood that XRP will emerge as a central player in modern finance. As we project into 2025, the overall sentiment towards cryptocurrencies is expected to evolve, backed by regulatory clarity and technological advancements. Investors are increasingly keen on understanding digital assets, further bridging the gap between traditional financial systems and the burgeoning digital economy.

Consequently, while challenges may still exist, the conclusion of Ripple’s SEC case offers a promising avenue for growth and stability for XRP. The potential for XRP to reach unprecedented highs amidst a favorable regulatory backdrop and industry maturation is a scenario that many are now eagerly anticipating. Thus, the focus will shift to how these developments will shape the future of XRP and what new opportunities may arise for investors and users alike in the years to come.

Share this content:

Post Comment