- Updates of soil and galaxy strategies have strengthened a long -term upper perspective

- However, the short term of soil remained jerky in the midst of the Mute retail sale interests

Institutional interest for Solana (soil) has remained high, despite the action of the mute prices of the token. On March 07, Canadian STRATEGIES, a pioneer of the business treasury via SOL, picked up 24,000 additional chips worth $ 3.3 million.

The company now holds 250.7K Sol and has extended to a complete service of services in the ecosystem, including the services of Validator and Sillat. According to the company, the last offer would strengthen its validator operations.

“This continuous accumulation is aligned with the company’s strategy to expand its soil participations to support its validator operations and its long -term investment approach in the Solana ecosystem.”

According to Antanas Guoga, president of Sol Strategies, the company would buy more soil during the “merger of the market”.

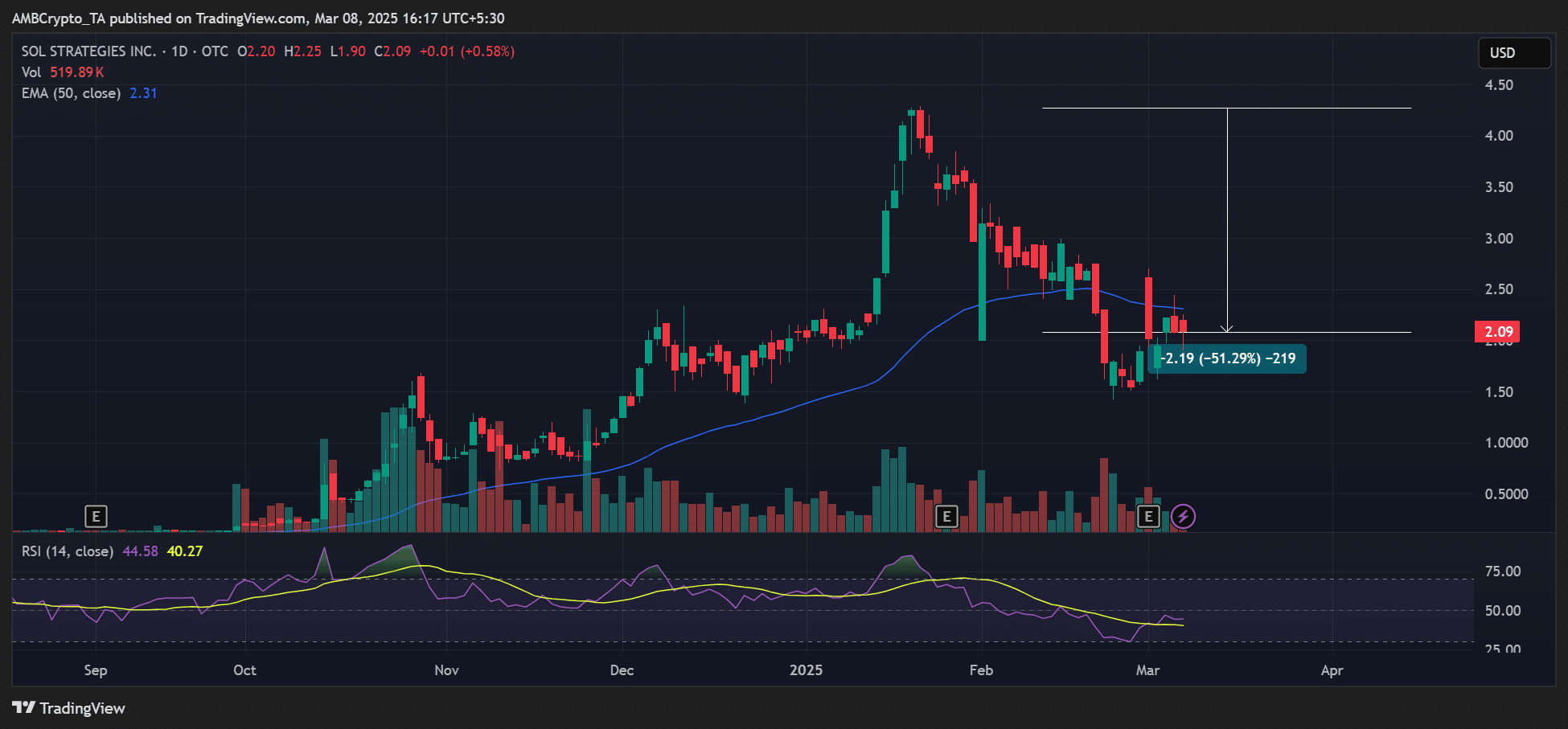

Recently, the company’s shares (CYFRF) have been increased by soil losses, lowering from $ 4.2 to $ 2. And yet, he still records electoral gains after the United States 156% at the moment.

Galaxy Pile 39 M $ Sol

In other news, Galaxy Digital has withdrawn 282.5K Sol, worth $ 40.5 million, centralized exchanges and marked $ 39.15 million (274,253 tokens), according to a report by Lookonchain.

In most cases, a hike in the clears is a bullish signal and a sign of long -term confidence in the ecosystem. In other words, the big players are always positive Sol’s outlook Currently, despite short -term flow.

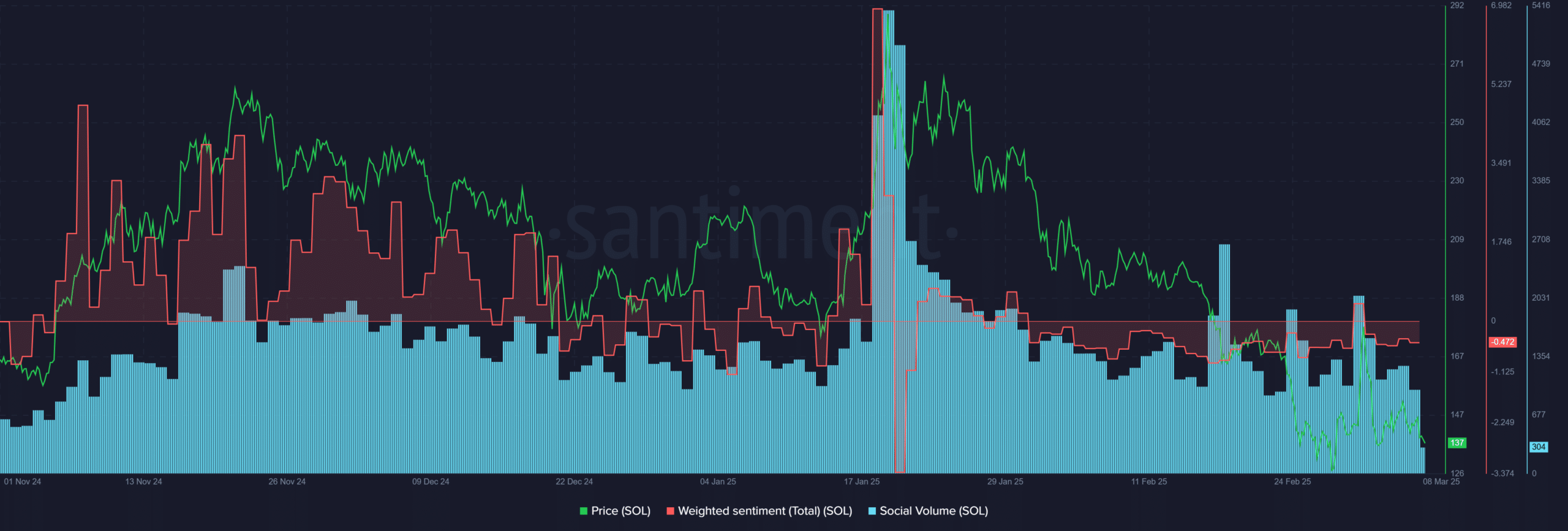

That said, the interest of retail investors for the token has dropped considerably since the Trump even made his debut in mid-January. This was revealed by the low social volume, in parallel with the too weak feeling after the implosion of the same scale.

Now the feeling has briefly become positive after the announcement of CME Futures on March 1. However, he did not support the dynamics for a long time. Unless the measures turn positively, soil recovery would remain elusive in the short term.

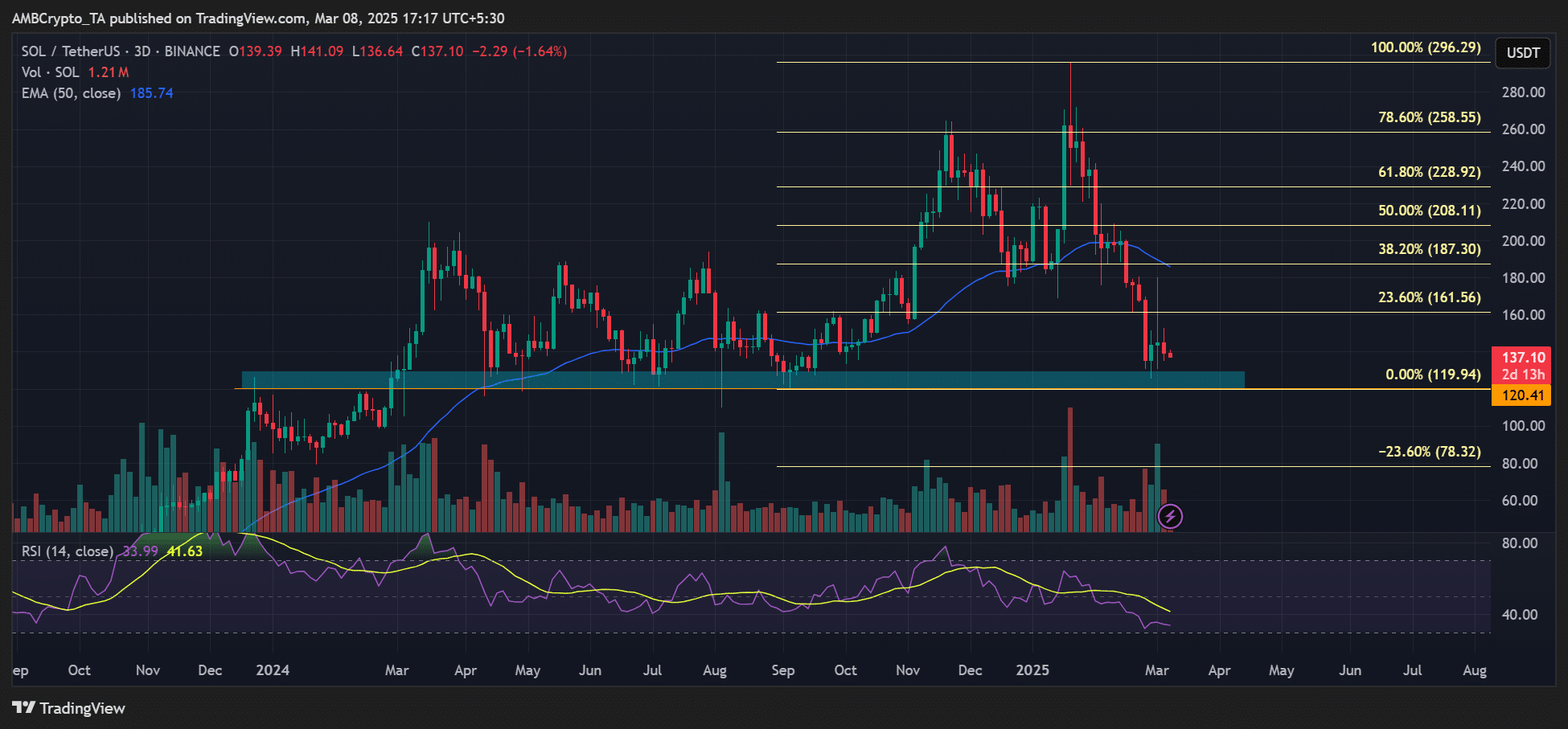

On the Polymarket prediction site, no more bettors to wait for Altcoin fell to $ 130 by the end of March. Interestingly, the Deribit options are considering $ 200 for the expiration of final-market options, but they only tariff 10% chance of resolving the objective.

Meanwhile, the price area of $ 120 has remained key support since the beginning of 2024. The bulls could try to defend it if the downward risk extends to the level.

(Tagstotranslate) Ambcrypto