- The new Bitcoin whales reshape the structure of the market, which stimulates demand while limiting the available supply.

- This dynamic can fuel the price movement on the upcoming in the coming months.

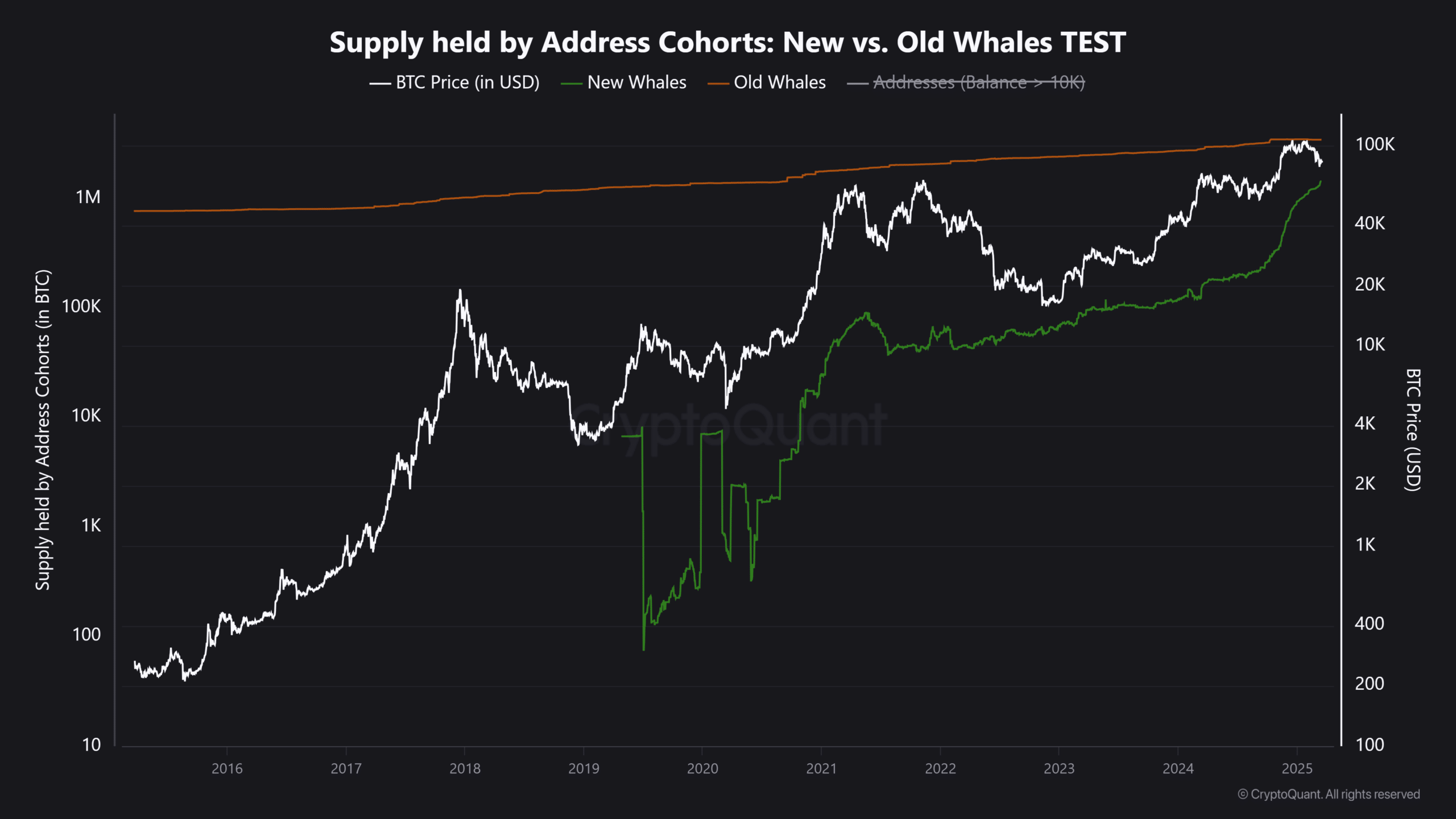

High Noue wallets with more than 1,000 Bitcoin (BTC) Ajoil quickly, signaling strong confidence in Bitcoin. Since November 2024, new Bitcoin whales have added more than a million BTC, including 200,000 this month.

A short period of detention (<6 months) indicates a strong conviction at current price levels. This sustained purchase pressure suggests that recent "dips" are absorbed, reducing the probability of prolonged corrections.

With a feeling of risk dominating the market, retail capital has no return yet. In this climate, the continuous accumulation of new whales could establish a low price, strengthening Bitcoin’s support in this cycle.

Bitcoin’s liquidity profile changes

The rapid accumulation of new whale addresses indicates strong inputs of fresh capital, as evidenced by the data below.

The total assets of these entities (more than 1,000 BTC, <6 months) went from 345K BTC to more than 1.5 million BTC. At the current market price of $ 83,580, this represents around $ 125 billion in Bitcoin.

Meanwhile, the long -term assets of whales (BTC held for several years) increased from 3.48 million to 3.45 million BTC, aligning with the correction of bitcoin prices from its $ 109,000 more on January 20 at $ 96,000 on February 6.

Liquidity for the sale of old whales and weak hands have been absorbed By these new whales, whose accumulation of 2,000,000 this month prevented BTC from tracing less than $ 78,000.

The new force of the Bitcoin whales signal: what is the next step?

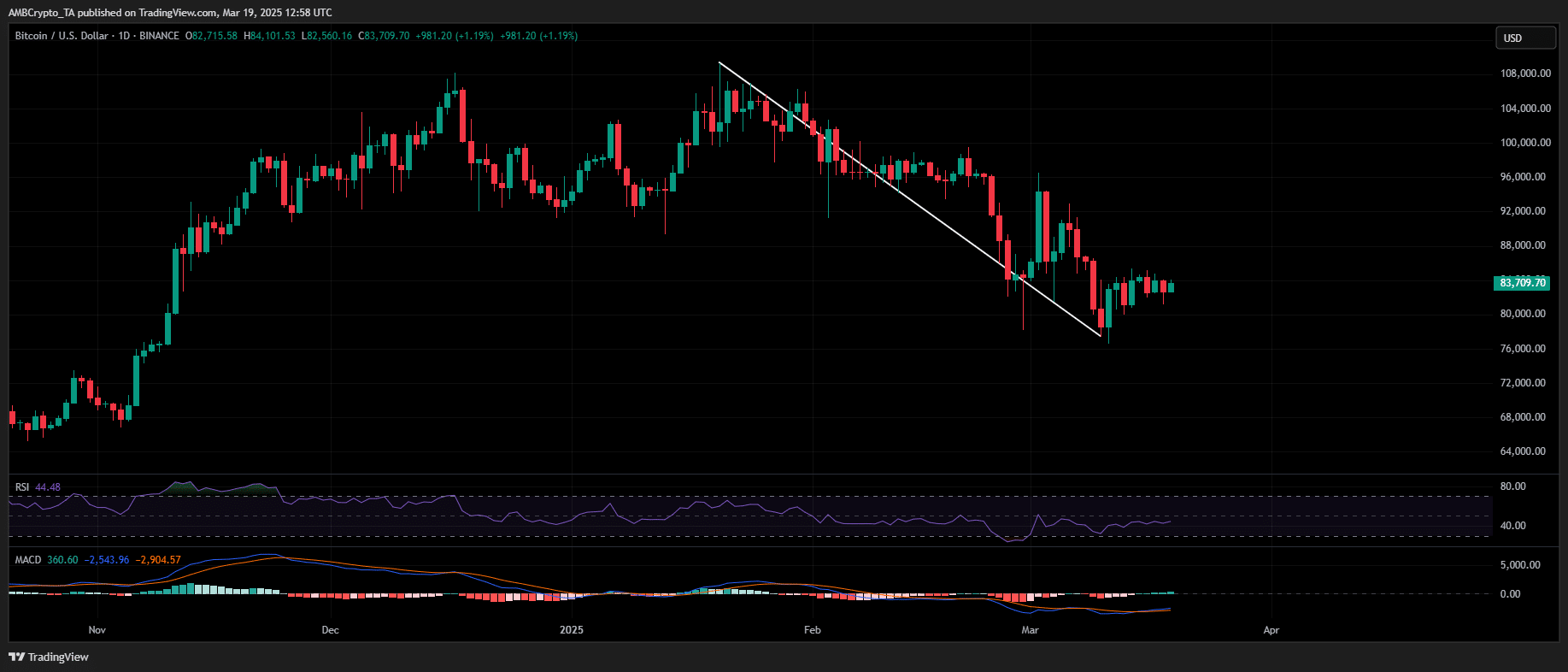

The recent Bitcoin price oscillations – from its $ 109,000 ATH to its drop below $ 80,000 – were largely influenced by Distributions of old whales and macro-piloted liquidity offsets.

However, the new whale entries strengthen support, attenuating lower risks. If the accumulation continues at the current levels, the probability of BTC of Retster of high increases of all time.

In addition, macro-factors such as potential rate drops, once Trump’s economic reset takes effect, could further strengthen Bitcoin’s long-term trajectory, positioning $ 150,000 to $ 160,000 as a viable long-term lens.

(Tagstotranslate) Ambcrypto

👑 #MR_HEKA 👑